Price or Terms

What's more important, Price or Terms?

The average rate for a 30-year, fixed-rate mortgage fell to 2.71% last week, the lowest number ever recorded by Freddie Mac's weekly survey of rates, which dates back to 1971.

This time last year, the average rate for a 30-year, fixed-rate mortgage was 3.68%. Even though prices are at an all-time high, here’s an example of why you might still want to consider purchasing a new home or investment property:

Using the above rates and a national average increase of 7% between this time last year, let’s look at the same property listed last year at $300,000 and the interest rate mentioned above compared to the same home currently available today on a conventional loan using an LTV (loan to value) of 80%.

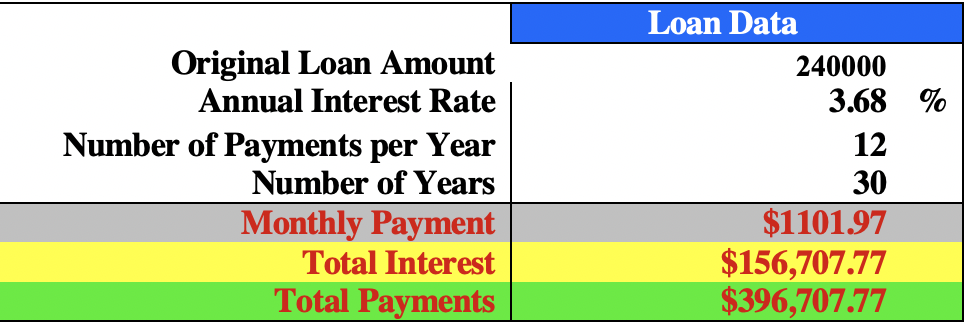

Home purchased on 12/9/2019 for $300,000:

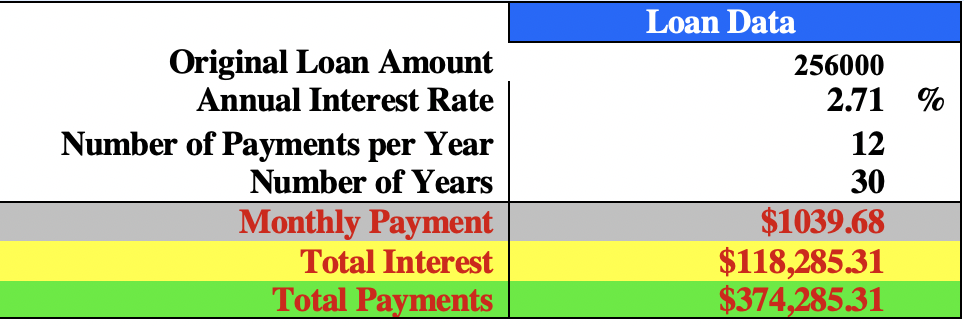

Same Home Purchased on 12/9/2020 for $321,000 (7% increase):

Purchasing the same home today would have a lower monthly payment of $62.29. If you kept the home for the duration of the loan, you would pay $38,422.46 less in interest and $22,422.46 in total payments.

As you can see, it’s not always about price.

Randy Hubbs

Designated Broker / Asset Manager

Founder of Investment Housing Specialists / Equity 1st Home Group

Co-Founder of Legacy Investors.US