Income and growth assets

Why you should consider income and growth assets

In a last article, we mentioned that high net-worth investors (HNWIs) are allocating around 30% of their portfolio in commercial real estate, which provides monthly or quarterly income, and growth (appreciation) that easily outpaces inflation.

Much of this is accomplished through private placements. Unfortunately, most folks are unaware this option exists because it’s rarely, if ever, discussed by financial advisors. In fact, most financial advisors know little or nothing about these because their formal investment education taught in college prepares them to work for firms that deal strictly with products traded on Wall Street. As a result, the only real estate products financial advisors typically deal with and understand are REIT’s – Real Estate Investment Trusts.

So, consider the famous quote below:

It only makes sense that financial advisors who are not familiar with private placements would be skeptical about the validity or legality of these.

Welcome to Main Street!

A private placement, or syndication, is a way for investors to purchase real assets like real estate, oil, and gas, precious metals, or non-publicly owned businesses, to name a few. As the name implies, these are securities, which are offered to investors through a private offering. The size of these groups can range from a few investors to a large number depending on the investment.

Keep in mind; just like the sale of stock on the public exchange, private placements are also regulated by the Securities Act of 1933 whose purpose is to ensure that investors receive sufficient disclosure when they purchase securities. Specifically, Regulation D of that act provides a registration exemption for private placement offerings. It allows an issuer to sell securities to a pre-selected group of investors that meet specified requirements (more on that later).

What’s important to understand is that depending on the type of offering; the issuer, or fund manager is responsible for adhering to strict guidelines which are governed by the Securities and Exchange Commission (SEC). This could include documents like a prospectus, private placement memorandum (PPM), and subscription agreement, all which are prepared by a highly qualified SEC attorney.

What’s most important to understand is that if offered by the right provider, private placements are legal, have been a tool used to create wealth by investors for many years, and are nothing to be feared!

Obviously, there’s a lot more information about private placements, which is why we feel it’s important to deliver in more than just one article. (Hopefully, your eyes haven’t glazed over yet…)

Again, if you can’t wait until then, you can always click on the link at the top of the 2nd paragraph which will take you to the SEC’s website and their explanation of private placements. You’re also welcome to reach out to us personally if you have questions or would like to learn more about how to get involved with these types of opportunities.

Why you should consider both income and growth assets.

Part 2

In our last article we discussed the basics of what Private Placements are and how they differ from the investment offerings typically found on Wall Street. If you did not receive or cannot find that article and would like to review it, please reach out to us and we can send you another copy.

As a result of the JOBS Act, which was signed into law in April of 2012, private investments were not as marketable or available to the general public thus making them primarily available for the well-connected and high-income earners. All of that has since changed and private placements now offer a wide variety of debt, equity and hybrid options. Many of these include cash flow equity appreciation, and tax advantages!

More individuals are now seeking these alternative investment opportunities that typically yield above-market returns to diversify from the traditional Wall Street based public offerings.

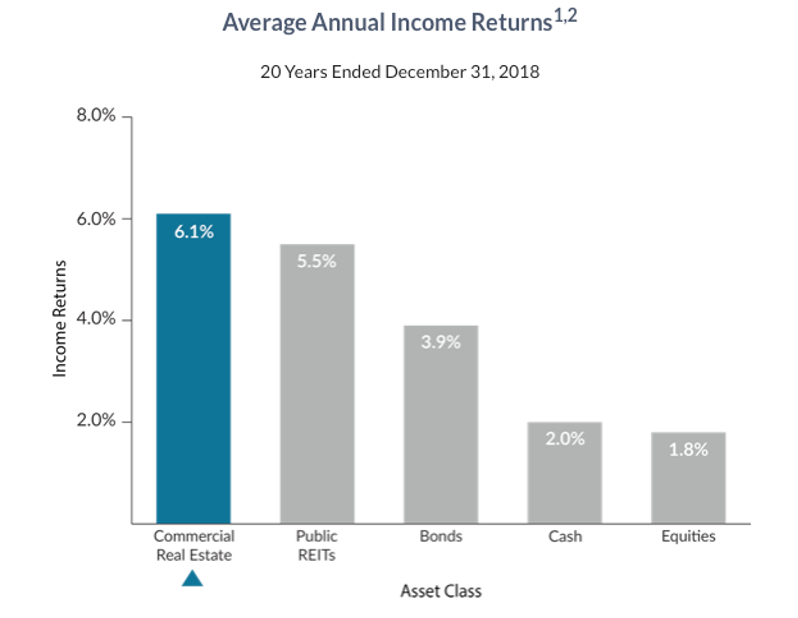

All financial advisors encourage their clients to invest in a diversified portfolio comprised primarily of stocks, bonds, mutual funds, REIT’s and other paper assets. Investing in private placements drastically increases the diversity in one’s portfolio has the potential to offer a variety of both short and long term returns that can lower volatility. More importantly, these are “Main Street” products consisting of hard assets such as real estate. One reason we love real estate is that it also offers tax saving opportunities and the ability to purchase assets at a fraction of their actual value using leverage. Real estate has also historically had a high risk-adjusted rate of return relative to stocks and bonds. Below is a chart comparing commercial real estate to other publicly traded products:

Investing passively in private placements allows an investor to leverage the knowledge and expertise of a sponsor whose company works with a team of experts including attorneys, bankers, accountants, property managers, and contractors to name a few. The sponsor is responsible for aggregating the capital from investors in the form of shares to acquire properties and manage the daily operations of these assets. In return for these services, the sponsor shares a portion of the profits with the investors

creating a stronger sense of synergy within the group. Communication is key which includes working with the above-mentioned team to provide scheduled reports and distributions to the shareholders including necessary tax preparation materials.

In this season of giving thanks, we are grateful to be able to provide these opportunities for our investors and thankful to have closed on another property yesterday that will provide safe and stable housing for children and adolescents with special needs in the Spokane Valley.

If you would like to learn how you can be a part of this socially conscious effort and enhance the ability to achieve the financial success you and your family deserve, please reach out to us for more details.

Randy Hubbs

Designated Broker / Asset Manager

Founder of Investment Housing Specialists / Equity 1st Home Group

Co-Founder of Legacy Investors.US